If you use a portion of your home for your business on a regular basis, you may qualify for the home office deduction. If you use your home, you must meet 3 rules to qualify. The IRS now offers a simple way to claim the deduction.

Working from home became widely popular during the pandemic, and now, many employees and employers are enjoying the flexibility this option allows. Those who use a portion of their home for business may even take a home office deduction.

Small business owners often benefit from not having to purchase or rent office space and opt for a home office instead.

If you work from home and have an exclusive space for working, what expenses can you write off on your taxes? How do you know what home office expenses are allowable?

Table of Contents

What Are The Benefits Of Having A Home Office?

There are many benefits of having a home office, including the following:

- Convenience: Your home office is super accessible!

- Cost Saving: Why rent an office off-site if you have the space in your own home?

- Flexible Hours: You are often able to set your own schedule.

- Time-Saving: No more long commutes to an office. You will save time.

- Work and Personal Life Balance: Work later in the day if you have a doctor’s appointment or have to pick up Billie from school!

What Is Considered A Home?

Your home is literally wherever you live. You can reside in a house you own or rent, but it does not have to be. Whether you rent an apartment or own a condominium, you may be eligible for the home office deduction if your domicile fits certain criteria.

Even if you live in an RV or houseboat as your primary residence and fulfill the three general rules for qualifying for the home office deduction, you can count it

What Are The 3 General Rules For Qualifying Your Home Office As A Business Expense?

People often inquire about the rules to follow regarding home office tax deductions. How do homeowners know if they can or cannot use a portion of their home toward their itemized deductions?

The IRS has three general rules to determine if they can write off their home office.

1. Exclusivity

In order to count, your home office needs to pass the exclusive use test. In other words, that part of your home has to be used exclusively for your home office to be allowable.

2. Regularity

The area of your home where you work needs to be used regularly, but not necessarily every day or even full-time.

Unfortunately, if you have an office in your home for your personal needs or you work from home as an employee, you do not qualify.

3. Precedence

The office space you use in your home must be your principal place of business. While you can have a secondary office, the home office space has to be your primary location.

Simply choosing to work from a home office, even if it is regular use, will not qualify if you have a physical office at another location where you conduct most of your business.

Do I Need To Have A Separate Room For My Home Office?

Although the easiest way to claim your home office on your taxes is to dedicate a spare room to becoming your workspace, that does not have to be the case. The catch is that you can only deduct the portion of your room that you can easily determine is the portion used for work.

If the room is divided in half, with a desk on one half and a bed on the other, you can argue that one-half of the room’s square footage qualifies for this tax break.

Do you have two people conducting business activities from your home? Does this tax cut pertain to both of you? As long as each of you has a separate workspace, you can both take this business deduction.

Is It Worth Claiming Your Home Office On Taxes?

So how do you figure out what your tax break will be? There are two methods.

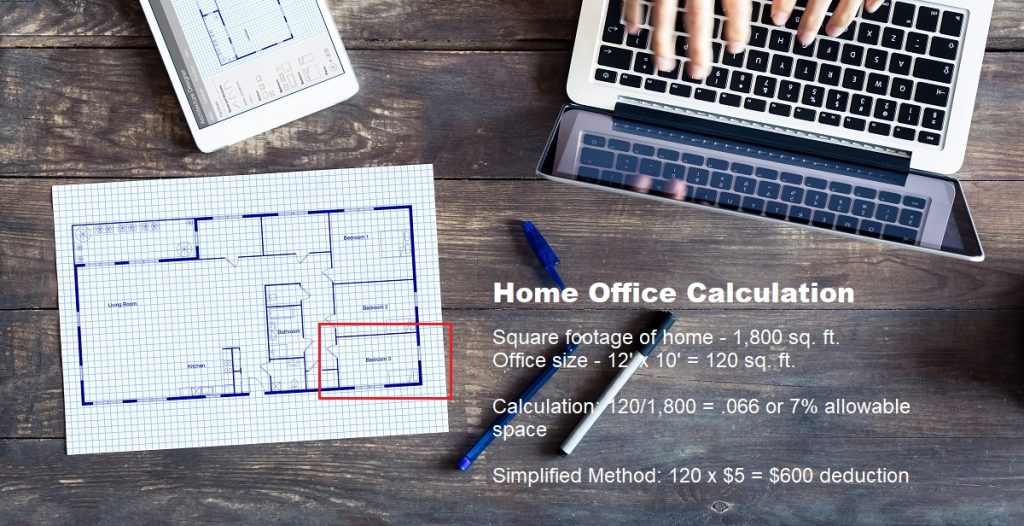

1. Square Footage Method

The first is the regular or square footage method. In this one, the business owner divides the square footage of the home office area by the total square footage of the home.

Here is an example. If your home is 2,200 square feet and your office space makes up 200 square feet, you can deduct 9% of any qualifying home expenses on your federal tax return.

Alternatively, if all of the rooms in your home are roughly the same size, you can allocate a percentage to the room. If there are 10 rooms in the house of comparable size, and you have one room used exclusively for business purposes, you could deduct 10% of qualifying home expenses if it fits all of the required criteria.

With this method, if you use 10% of your home for business, you can deduct 10% of your mortgage interest or rent and utilities (electric, water, and gas), plus 10% of homeowners insurance and other whole-house expenses, such as cleaning and exterminator fees.

Simplified Method

There is also a simplified method, also called the safe harbor method. According to Turbo Tax, the prescribed rate for the 2022 tax year was $5 per square foot with a maximum of 300 square feet.

What this means is if the office measures 150 square feet, then the deduction would be $750 (150 x $5). Of course, all the rules still apply regarding how the space must be dedicated to business activities.

It is worth reminding business owners that if any part of the room your home office is located in is used for personal use, such as living or sleeping space, you cannot deduct the entire room.

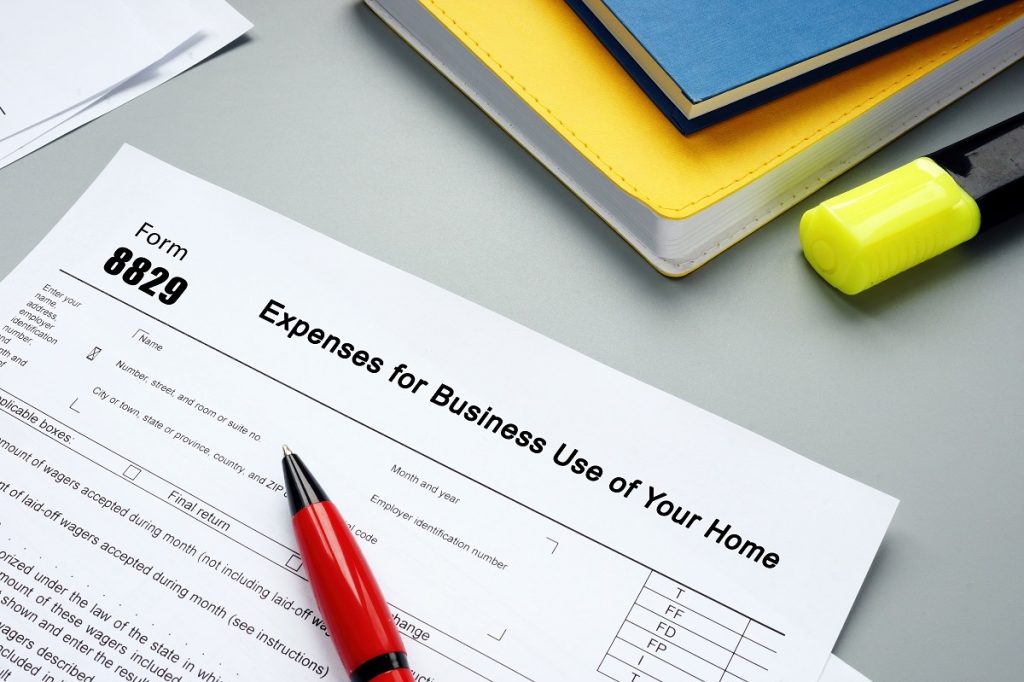

The IRS allows you to determine each year if you will use the square footage or simplified methods. You claim the deduction on Form 8829 when you file your taxes.

Challenges Presented During The Pandemic

During the recent Covid outbreak, many workers were sent home from the office to do their work at home. Many set up home offices, bought furniture, and maybe even replaced their computers. Unfortunately, as they were still employees, they would not qualify for the home office deduction.

The 2018 changes in the tax law specified that those who worked from home as employees could no longer deduct expenses connected with working from home. This proved to be an ill-timed change, given Covid shutdowns just a couple years later.

However, if you had a side gig that required you to have office space or were self-employed as a consultant or other professional, you could take the deduction for that work.

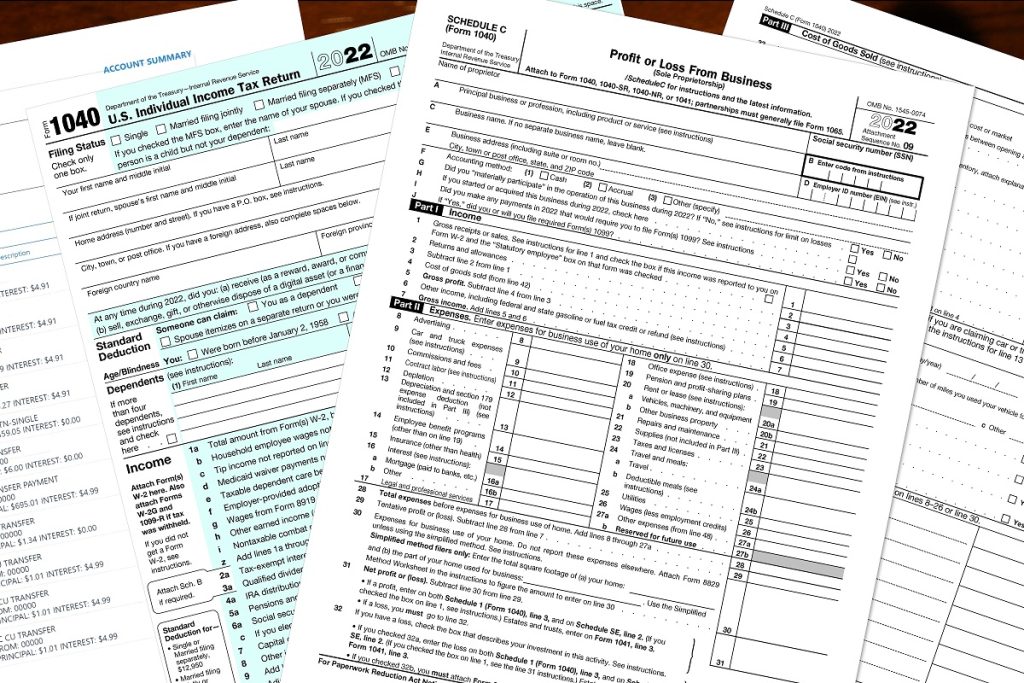

If you claim the deduction, you would have to file Schedule C to show profit and loss from your business and have some Schedule C income for the year. The deduction cannot be bigger than the income generated by your work.

What Are The Limitations Of Home Office Deductions?

The acceptable expenses are mortgage interest or rent, homeowners insurance, real estate taxes (property taxes), utilities, repairs and maintenance, and depreciation. These are all considered indirect expenses. Direct expenses to maintain the office space are allowable, such as painting or putting new flooring in the home office.

Other home-related improvements would only be allowed if you can illustrate how they are related to the business. For example, while most business owners could not deduct the cost of landscaping the home, the landscaping business owner could, as they could show prospective clients what your service might include.

If you use your internet for your home office, you can claim part of the expense, but you need to quantify what percentage of the expense you use for work. The same is true of cell phones. If you have a landline dedicated to the business, that would be 100% deductible. You can claim very few actual expenses in full for your home office, as most are percentages.

What About In-Home Day Cares?

For those who operate a daycare in their home, the rules are a bit different. Since entire portions of a house are used for daycare during business hours and personal use at all other times, there is a formula for computing your tax credit for business use of your home.

To start the calculation, you need two percentages: the percentage of space used for the daycare and the percentage of annual hours you are operating the daycare. Next, divide the square footage of the space you use for the daycare by the total square footage of your home. This can include the living room, kitchen, daycare-related storage, nap areas, etc.

Next, you want to figure out the total household expenses, including mortgage interest, property taxes, utilities, etc. To figure the percentage of these deductible expenses, multiply the total by the percentage of the areas you use for business and the number of hours you use your home as a workplace.

It is important to note that you can only claim deductible expenses as you have brought in as revenue for the year.