If you work from home and your employer issues you a 1099 rather than a W-2, you are considered an independent contractor. What you can claim on taxes as an independent contractor varies from what you can claim as an employee. Covid has presented new tax challenges for many workers.

Many people seeking to improve their work and home life balance find themselves a work-from-home gig where they work for themselves as independent contractors. As they are self-employed, they are among the growing number of Americans with 1099 work-from-home jobs.

Nearly 16.2 million people or 10.1% of the workforce are full-time self-employed as of January 2023. The number of workers who occasionally work independently rose from 15.8 million in 2020 to 31.9 million workers on 2022.

Rather than getting a W-2 that reports your wages and the amount of taxes withheld, you receive a statement of your gross pay.

Table of Contents

What Is The Difference Between a 1099 and a W-2?

For all sources of income, the government expects to get a percentage of wages in the form of taxes to maintain infrastructure throughout the country and pay for other services it provides.

Employees are usually paid with a W-2 wage and tax statement that also takes out taxes for states and municipalities. The amount of taxes an employer withholds corresponds to information about the filing status the employee has provided.

Employers must issue these to anyone who has worked part-time or full-time and made $600 or more, but the employee is supposed to report any income.

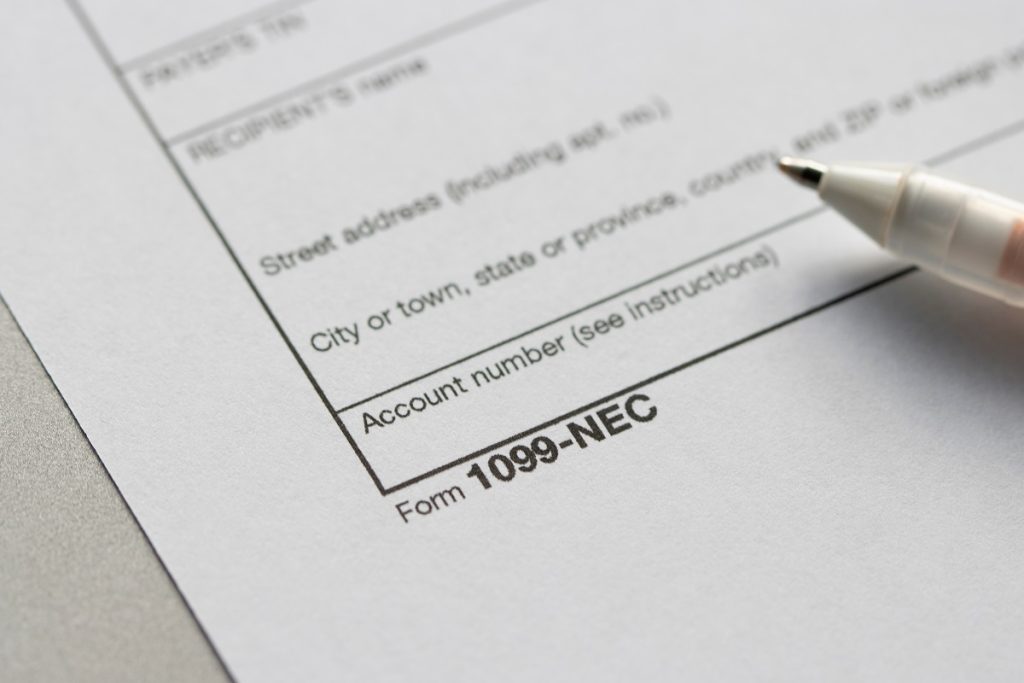

Those who work as freelancers or independent contractors or have their own businesses receive their gross pay on payday but still owe taxes. The income is reported to the IRS on a 1099-NEC form for non-employment income. The 1090-NEC is part of a family of forms for accounting for non-employment income.

Independent contractors who receive business income and are considered businesses must file a Schedule C in addition to their 1040 tax form.

What Are The Pros and Cons Of Being An Employee Vs. An Independent Contractor?

Those in an independent contractor position have some definite perks.

- Choice of clients to work with as you find your own jobs.

- Control over which jobs you take. If you don’t like the work, pay, or hours, you can decline to work for specific clients.

- Flexible hours and flexible schedule. The ability to make your own hours and decide your own schedule is the primary perk listed by those who work for themselves.

- Increased income potential. You may be able to command above-market rates to maximize your earning potential if you have something unique to offer.

- Location flexibility. You can work from home, a coffee shop, out of state, or out of the country with some job types!

- Work and home life balance. The flexibility of remote jobs has been shown to improve the balance in many people’s lives.

- Ability to deduct business and home office expenses, such as computer equipment, internet service, dedicated office space, supplies, cell phones used for business, etc.

The prospect of no commute, a relaxed work atmosphere, and the freedom to run an errand or pick up your kids without having to clear it with your employer is compelling. What are the downsides of being an independent contractor?

- Independent contractors must hustle for jobs, especially if they need full-time income. This may mean having multiple projects and multiple clients, which can be challenging.

- Benefits are not usually available, which means no health insurance, paid time off, or vacation pay. Finding affordable healthcare can be a challenge for those working as independent contractors.

- Contractors must pay taxes directly to the federal, state, and local governments as they are not withheld from pay. This is less convenient than having money you will eventually owe taken out. Most contractors must file estimated taxes throughout the year.

- Those who work for themselves must pay self-employment taxes to cover Social Security and Medicare. This amounts to 15.3% on 92.35 percent of your net earnings from self-employment.

How Has Covid Impacted Tax Liability?

Due to changes in the tax law effective in 2018, employees who work from home cannot take the home office deduction and other unreimbursed employee business expenses for tax years 2018 through 2025.

Before that, remote workers often qualified for the home office deduction even as employees if they worked at home for the employer’s convenience.

However, employees who had access to a brick-and-mortar business but chose to work remotely for convenience – such as to avoid a long commute or due to childcare situation – did not qualify. For tax years 2018-2025, the convenience rule is irrelevant. Only 1099 workers can claim the deduction.

During the pandemic, many employees ended up working from home due to a public health crisis, not just convenience. They expected to be able to claim the home office deduction and other expenses by itemizing deductions on Schedule A.

Covid hit three tax years into this period where the deduction was not in effect. Employees who worked at home during shuts downs or had a hybrid or remote work arrangement did not qualify for tax relief as they set up home offices and bought supplies and equipment.

According to the Tax Cuts and Jobs Act of 2017, contractors working on a 1099 basis can still benefit from business deductions as they claimed the homes as the principal site where they conduct business.

Even someone who does work as a contractor and a remote employee can claim the deduction so long as they did some work as a freelancer.

4 Questions to Ask About Your Tax Liability As An Independent Contractor

Working for yourself might be freeing, but it does not relieve you from the responsibility to pay tax taxes.

1. What type of employee are you?

If you are a remote employee, the employer will ask you to fill out W-2 paperwork when you start. This means you technically work for that business or company.

Independent, remote contractors are self-employed and must pay quarterly taxes. When they accept work from clients, they may have to fill out a W-9 to report 1099 income to the government correctly.

A remote worker with a variety of jobs might be an employee for some and an independent contractor for others.

2. Where are you located?

Incomes are taxed based on where you live, but you can also be taxed differently if you work remotely from another location. You may have to pay taxes in more than one state or city. If you are a digital nomad, you must pay U.S. taxes and may even be liable for foreign taxes.

Various countries, states, and municipalities have different tax requirements, so you must be aware of tax laws for the area(s) where you work. Consulting a tax professional to learn your tax liability is always a good idea if you plan on working out of state or out of the country.

3. Do you owe quarterly tax payments?

If you file taxes with 1099s, you must pay estimated quarterly taxes to the IRS and local taxing bodies. Failure to pay can result in an underpayment penalty.

4. Do You Know What Records You Need To Keep?

Having clear and organized records about your work is essential for reporting purposes. While you do not have to submit them with your tax returns, you should have them available in case of an audit.

The IRS does audit 1099 workers, sometimes randomly and sometimes because certain expenses seem out of line with income. Your chances of getting audited are low, but you should have receipts and other documentation on hand for three years.

What Are Some Popular 1099 Work-From-Home Jobs?

Some typical independent contractor jobs that are often remote include”.

- Bookkeeper

- Call Center Worker

- Customer Service Representative

- Data Entry

- Proofreader

- Social Media Manager

- Speech Language Pathologist

- Virtual Assistant

What Is The Best Way To Find 1099 Work From Home Jobs?

When looking for a work-at-home job, the job description often indicates whether you are an employee or contractor.

When you Google “work-from-home” job opportunities, the job post may indicate that you will be an independent contractor. Many remote gigs and part-time opportunities do not pay benefits; if a job description stresses benefits, you may be an employee.

Are There Companies That Often Hire 1099 Workers?

Sometimes people are surprised to hear that there are some large companies, such as Amazon and Apple, that hire 1099 workers as private contractors. Here is a list of 100 companies that offer remote positions as independent contractors