For Americans, the requirements to file and pay U.S. income tax continue even when someone works remotely in a foreign country. There are some tax benefits digital nomads can use, but you must still pay your taxes when they are due. Digital nomads may be exempt from tax in a foreign country for time on some visas.

The rise of the digital nomad lifestyle has transformed how people work and live. This new breed of professionals leverage technology to work remotely from anywhere. While this offers flexibility and freedom, it also raises questions about digital nomad tax obligations.

Most citizens of the world pay income tax on what they earn and are liable for other taxes as well. For those who live and work in the same area, paying taxes is straightforward, but what if someone is a citizen of one country yet works in another? Or if they live in one state and work in another?

As digital nomads operate in a global marketplace, the traditional tax system needs help to keep up with their unique circumstances. This article explores the challenges and opportunities of taxation in the digital nomad era.

Table of Contents

What Taxes Do Digital Nomads From The U.S. Have To Pay?

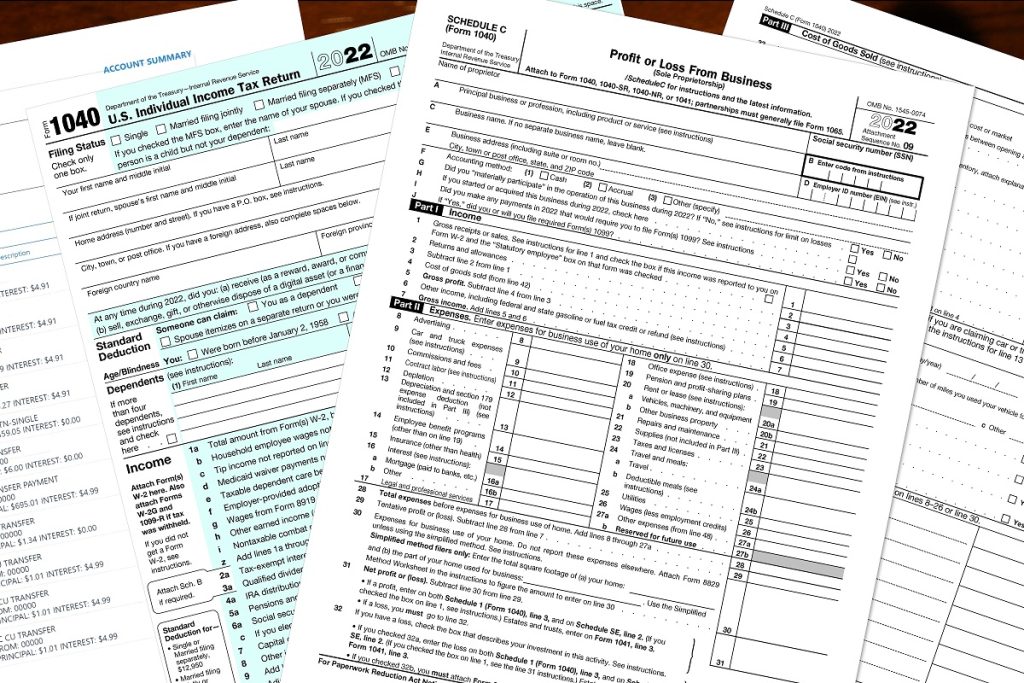

Digital nomads from the U.S. are still subject to U.S. tax laws, regardless of where they work and earn income. This means they may need to pay federal income tax, self-employment tax, and possibly state taxes, depending on their residency status and where they conduct business.

As digital nomads are usually considered self-employed, they are liable to pay 15.3% of their income for self-employment taxes – 12.4% for Social Security and 2.9% for Medicare.

Digital nomads who spend significant time abroad may also be subject to foreign taxes or have to navigate complex tax treaties to avoid double taxation. Many nomads qualify for the Foreign Earned Income Exclusion (FEIE), which makes the first $120,000 of foreign-earned income not subject to U.S. tax. Nomads might also qualify for a Foreign Housing Exclusion and Foreign Tax Credit.

To be eligible for these tax breaks, digital nomads must pass either a physical presence test or a bona fide residence test to determine their place of residence during a given year.

Each country has its own tax laws and requirements, so digital nomads must research and understand the tax regulations of the countries where they are working. Keeping detailed records of income, expenses, and tax filings is crucial for compliance with international tax laws.

U.S. digital nomads must understand their tax obligations and consult a tax professional to ensure compliance and minimize tax liabilities.

What Are Some Disadvantages Of Being A Digital Nomad From A Tax Stand Point?

One disadvantage of being a digital nomad from a tax standpoint is the complexity of complying with tax regulations across different countries. Digital nomads often work and earn income in multiple jurisdictions, creating confusion and increasing the risk of errors or penalties.

Another challenge is that digital nomads may need a fixed tax residence, which affects their tax obligations and eligibility for certain deductions or credits. Additionally, some countries may require clear rules or guidance for digital nomads, leading to uncertainty and potential tax liabilities.

Finally, the lack of a consistent income stream and irregular work patterns can make planning and managing tax payments difficult.

What Is The Difference Between A Tourist And A Digital Nomad?

A tourist travels temporarily for leisure or recreational purposes, typically for a short time. On the other hand, a digital nomad is a location-independent professional who uses technology to work remotely from anywhere in the world.

While both travel abroad, the purpose and duration of their stay are different. Tourists typically do not earn income while traveling, whereas digital nomads often work remote jobs and earn income while exploring new places.

Can Digital Nomads Avoid Paying Taxes?

Digital nomads are still subject to tax laws and regulations, and failing to comply can result in penalties and legal issues. However, they may use tax deductions and credits to reduce their tax liabilities.

Additionally, by planning their travel and work arrangements carefully, they can minimize the amount of taxes they owe or take advantage of tax treaties between countries. Digital nomads must understand their tax obligations and consult a tax professional to ensure compliance and optimize their tax situation.

How Long Can You Stay In Digital-Nomad-Friendly Countries Before You Are Taxed?

The United States has a citizenship-based tax system whereby U.S. citizens must pay taxes to the government regardless of where they live. Other countries usually use residence-based taxes, while a few only tax income sourced from within their border.

Most countries only taxed digital nomads and others in residence for 183 days or more. A few countries, such as the Bahamas, Croatia, Malaysia, and Seychelles, do not require digital nomads to pay taxes.

Please note that if you wish to stay beyond the stated length duration, you may need to obtain a business visa or work permit.

What Can You Write Off As A Digital Nomad?

Some countries allow digital nomads to write off certain expenses on their taxes, including travel expenses, home office expenses, equipment and software, internet and phone bills, and professional development and education costs. However, you should keep accurate records and ensure the fees relate directly to your business.

Additionally, tax laws and regulations can vary depending on the country, so it is essential to consult a tax professional to determine what expenses can be written off.

Which Country Has The Best Digital Nomad Taxes?

Some countries are known for their relatively low tax rates, such as the United Arab Emirates, which has no personal income or corporate tax. Some countries in Southeast Asia, such as Thailand and Malaysia, have relatively low tax rates and favorable tax rates policies for foreign workers.

Several countries have attractive tax arrangements for digital nomads. Portugal, for example, offers the Non-Habitual Residents (NHR) policy which provides tax benefits to people who have relocated there. This arrangement makes Portugal one of the most tax-friendly countries for digital nomads from E.U. and non-EU countries.

As noted above, Americans must still file income taxes with the IRS regardless of where they live or travel. In some cases, you may not owe any taxes on your earned income due to special deductions.

However, taking advantage of special deductions such as foreign earned income and housing exclusion is possible, resulting in little to no taxes owed on earned income. You may realize significant tax savings by combining these deductions with a tax-free digital nomad visa.

What Are Some Reasons Digital Nomads Choose To Be Tax Resident In A Country?

Digital nomads may become tax residents of a country for several reasons, such as establishing a stable base for their business operations, gaining access to local amenities and services, qualifying for government benefits, and simplifying their tax situation.

By becoming a tax resident, digital nomads can also take advantage of certain tax benefits and deductions that may not be available to non-residents. Being a tax resident may also provide greater legal and financial stability for the digital nomad’s business and personal life.

A Foreign Bank Account

Having a foreign bank account is common for digital nomads, but it’s important to comply with reporting requirements to avoid penalties. Also, maintaining a valid driver’s license and establishing a physical presence in the country where you work can demonstrate ties to that country for tax purposes.

As the world becomes more connected, digital nomads have become a growing trend, and tax laws are continually evolving to keep pace. When traveling from country to country, it’s crucial to understand your tax obligations to avoid any legal issues or financial penalties. By staying informed and seeking professional advice when needed, digital nomads can enjoy the freedom of remote work while remaining compliant with international tax law.