When remote workers or hybrid workers set up offices at home, laws differ regarding whether the employer must reimburse business expenses. Eleven states have statutes that supplement bare-bone federal statutes. Many employees provide their workforce with the basics they need to do the job.

Remote work has become popular for many companies, especially after the pandemic forced businesses to adopt a remote working model. However, with the rise of remote work comes the challenge of ensuring that employees are properly reimbursed for work-related expenses incurred while working from home.

This article explores the key components of a remote employee reimbursement policy, including what expenses should be covered, how to submit them, and how reimbursement will be processed. We’ll also discuss best practices for establishing and communicating the policy to employees.

Table of Contents

What Are Some Benefits Of Remote Work For Employers and Employees?

Remote work offers several benefits for employers and employees. For employers, remote work reduces overhead costs, including office space and utilities. It also allows companies to expand their talent pool and access more skilled workers worldwide.

Remote work also leads to higher team member productivity, as employees often work in a more comfortable and personalized environment. It also enables employees to balance work and personal responsibilities, leading to higher job satisfaction and lower turnover rates.

For employees, remote work offers greater flexibility, allowing them to work from anywhere with an internet connection. This is particularly helpful for employees with long commutes or those with family or personal responsibilities that make traditional office hours difficult to maintain.

Remote work also reduces stress and burnout, as employees often take breaks or engage in self-care activities more easily when working remotely.

Should Employees Be Reimbursed For Working From Home And Setting Up A Home Office?

In general, employees should receive reimbursement for expenses related to working from home and setting up a home office, especially if remote work is a long-term or permanent arrangement.

Employers benefit from remote workers, so reimbursing them for needed work supplies will ensure that they do the job professionally.

Providing Clear Guidelines

Remote employee reimbursement policies are crucial for employers to establish, as they provide clear guidelines for what expenses will be reimbursed and how employees should submit them for reimbursement. These policies cover office equipment, internet and phone bills, and even home office rent.

To ensure compliance with applicable law, employers should establish clear, written policies on business expense reimbursement. They should have a fair and consistent remote employee reimbursement policy to treat all employees equally and fairly.

Additionally, a good approach helps employers attract and retain top talent by demonstrating their commitment to supporting their remote workforce.

Companies should also be aware of the employer reimbursement laws in their jurisdictions and ensure that their policies comply with those laws.

Additional Expenses

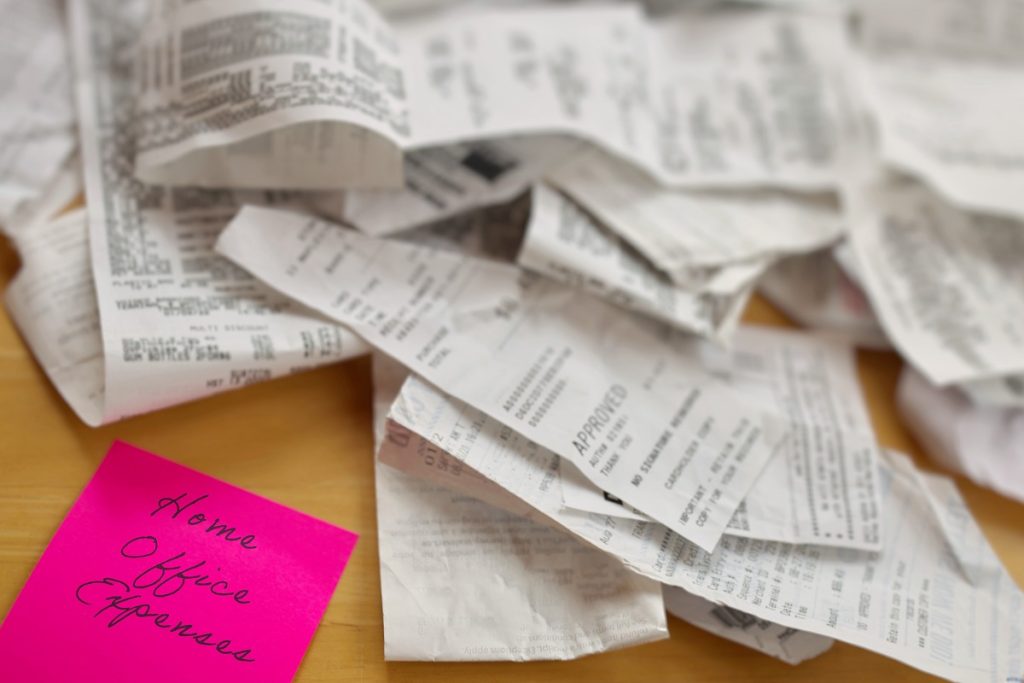

Employees working from home may incur additional expenses such as higher electricity bills, internet costs, personal cell phone use, and purchasing office supplies or equipment such as a desk, chair, or monitor. These expenses add up and may create a financial burden for employees.

Therefore, companies must establish a clear policy for reimbursing employees for these expenses. This policy should include how long the reimbursement process will take.

Stipends

Employers should also consider providing employees with a stipend or allowance to help cover these expenses rather than reimbursing them on a case-by-case basis.

This approach streamlines the reimbursement process and reduce administrative burdens for both employers and employees.

What Is The Difference Between A Stipend And A Salary?

A salary is a fixed, regular payment to a team member for their work.

A stipend, on the other hand, is a fixed sum of money paid to an individual to cover specific expenses or costs.

While a salary is typically paid in exchange for work performance, a stipend is usually delivered to cover expenses associated with a particular activity, such as research or education.

Stipends are often used when the individual receiving the payment is not considered a team member, such as in internships, fellowships, or other short-term arrangements.

What Is An Example Of A Remote Work Stipend Policy?

An example of a remote work stipend policy is one in which the employer provides a set amount of money each month to cover expenses related to remote work.

For instance, the employer may provide employees with a $100 monthly stipend to cover the cost of internet service, office supplies, and other work-related expenses.

The policy may specify which expenses are eligible for reimbursement and require employees to submit receipts or other documentation for reimbursement.

This approach simplifies the reimbursement process and ensures employees have the necessary resources to perform their jobs effectively while working remotely.

What Is The Federal Law On The Subject?

Currently, no federal law requires employers to reimburse employees for work-related expenses incurred while working from home. However, some states have implemented their own regulations regarding team-member reimbursement.

For example, California requires employers to reimburse employees for all necessary expenses incurred while performing their job duties. Illinois, New Hampshire, and South Dakota also have laws related to employee expense reimbursement.

The Fair Labor Standards Act (FLSA) also requires employers to pay employees for all hours worked, including any time spent performing work-related tasks outside of normal work hours. This could include setting up a home office or other work-related tasks.

Which States Require Remote Work Reimbursement?

Several state laws require employers to reimburse employees for necessary expenditures incurred while performing their job duties.

These laws often require reimbursement for expenses required to complete work in a safe and ergonomic manner.

California Requires Employee Reimbursement

As mentioned, California is one such state, and its law requires employers to reimburse employees for all necessary expenses incurred while performing their job duties, including costs related to remote work.

Several states and the District of Columbia have laws or regulations that require employers to reimburse employees for certain expenses incurred while working remotely. Illinois, New Hampshire, and South Dakota also have laws related to employee expense reimbursement that could apply to remote work expenses.

Other States Requiring Remote Reimbursement

Here are some states that require remote work reimbursement:

- Iowa has no specific law requiring employers to reimburse remote workers. However, employers must reimburse employees for any expenses incurred on behalf of the employer, including those incurred while working from home, under Iowa’s wage payment laws.

- Massachusetts requires employers to reimburse employees for expenses incurred while working remotely to fulfill their job duties, including internet, phone, and other equipment expenses.

- Montana’s wage and hour laws require employers to reimburse employees for all necessary expenses incurred directly from employment, including costs related to remote work.

- Minnesota, Pennsylvania, North Dakota, and New York law requires employers to reimburse employees for all necessary expenses incurred during employment, including costs related to remote work.

- The District of Columbia has a regulation that requires employers to reimburse employees for all reasonable and necessary expenses incurred in performing their duties, including costs related to remote work.

What Are The Advantages Of Remote Work Reimbursement?

Offering remote work reimbursement provides several advantages for both employers and employees.

For employers, it attracts and retains top talent by demonstrating a commitment to supporting their employees and providing a competitive benefits package.

It also improves team member satisfaction, productivity, and morale, positively affecting a company’s bottom line.

For employees, remote work reimbursement reduces the financial burden of working from home, increases motivation and job satisfaction, and improves work-life balance.

What Is The Difference Between A Work-From-Home Policy And A Remote Work Policy?

A work-from-home policy typically applies to employees who work from home on a short-term or occasional basis, such as during inclement weather or when a team member needs to stay home for a personal matter.

On the other hand, a remote work policy typically applies to employees who work from a location outside of the traditional office, such as a home office or a co-working space, on a regular or full-time basis.

A remote work policy generally covers a wider range of topics, including guidelines for setting up a home office, internet and technology requirements, and procedures for communication and collaboration with coworkers.

Both policies are important for companies to have in place, but they apply to different work arrangements and require different levels of planning and support.

What Expenses Might Employers Reimburse?

Employers may reimburse employees for various expenses related to remote work purposes, including:

- Since remote work requires reliable internet access, employers may reimburse employees for the cost of their internet service.

- Employers may also reimburse employees for purchasing or upgrading equipment necessary for remote work, such as a laptop or a headset.

- Employers may reimburse employees for buying office furniture, such as a desk or chair, for creating a comfortable and productive workspace at home.

- If a team member occasionally needs to travel to the office or other work-related locations, employers may reimburse them for parking and gas expenses.

- For employees who use their vehicle for work-related travel, employers may reimburse them for mileage following the current IRS mileage rate.

In Summary

In summary, employers should reimburse expenses employees incur for work outside the team member’s everyday business use.

Employers must have an expense reimbursement policy to ensure compliance with applicable state and federal laws, including minimum wage requirements, and establish clear guidelines for reimbursement requests and eligibility criteria.